Your attitude to risk will play a major part in how you approach financial planning during your lifetime.

In general, the more risk you take the higher the potential returns. Also, the longer you are looking to invest, the higher your risk tolerance could be, as investments are more likely to smooth out over the long term.

However, there are different levels of risk. For example, buying shares in a large multinational company like Apple and buying shares in a start-up company are both investments, which have some element of risk. But it may be considered safer to invest with Apple as they are large and more financially stable, although potential returns may not be as high. Of course, there is always a risk that even the largest companies can fail and you can lose some or all the money you invest with them.

Being aware of your risk appetite is especially important when planning your long term financial future. The aim is to put together a savings and investment strategy that matches your financial goals but doesn’t leave you worried about the level of risk.

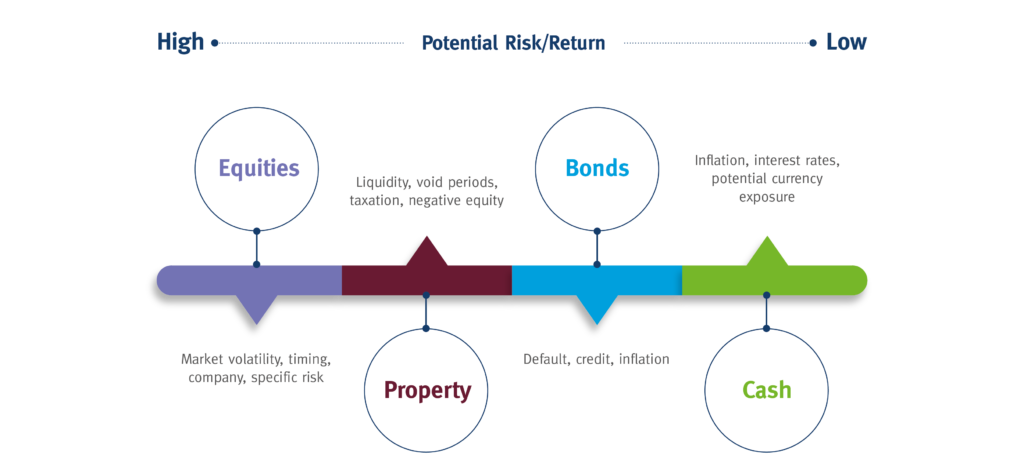

The risk ladder gives you some indication of where on the risk line various savings and investments fall and what risks you could be exposed to.