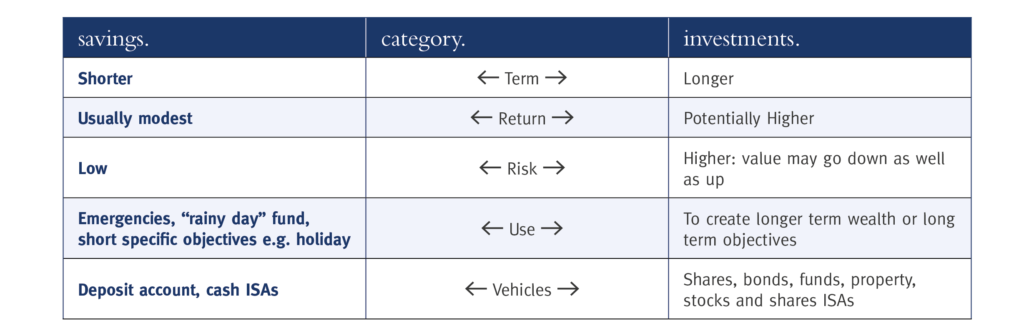

Savings are generally shorter term, lower risk and placed to earn interest and are available for withdrawal, sometimes subject to notice.

See the table below for a brief summary of the differences between the two.

See the table below for a brief summary of the differences between the two.

Remember: No one type of investment or savings vehicle will meet all needs so a balance of these is necessary, if you are to have a stable standard of living and a sense of financial security.

There are a number of considerations for you to take into account when planning how to save or invest. See below for more information.

First you must assess your financial needs and goals. Ask yourself:

Answering these questions will be a useful way to help work out what the most suitable way to save or invest your money could be. Highlighted below are some external factors that could affect your returns and will be important to keep in mind when making a decision on how you will save or invest your money.

Over time inflation will reduce the value of your capital in real terms.

For example, if inflation was at 5% p.a. the real value of £10,000 after 5 years will be £7,835; after 10 years, £6,139; and after 20 years £3,769. These figures are illustrative only as inflation has been lower than 5% over the last five years so the true value of your capital in real terms would be higher.

How safe is your capital? Money lost through speculative investment can be hard to recover and may affect your standard of living for the rest of your life. There are two factors that can give you an element of security:-

The impact of taxation on your savings and investments is a crucial factor in their selection. If your savings or investments are not in an ISA or pension, any gains could be taxable.

A comparison of the ‘gross’ (i.e. before tax) returns is often misleading. A better indicator of returns is the ‘net’ (i.e. after tax) position.

If your circumstances change, or if the tax or investment climate changes, the way in which you have invested your money originally may no longer be appropriate. Therefore, it is important to review your investments to make sure your investment strategy still aligns with your end goal.

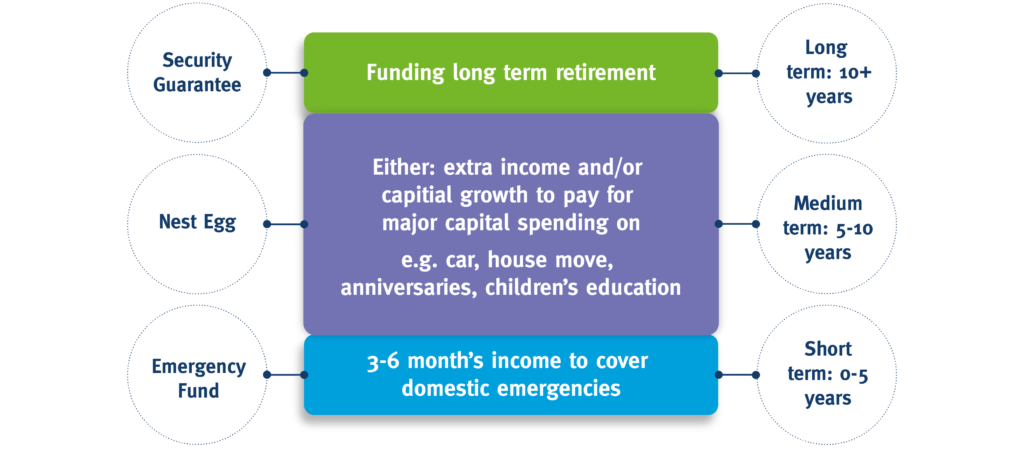

Below is an example of how your money could be needed, from providing a short term emergency fund for everyday needs through to potentially providing money for longer term requirements at-retirement. This will not be applicable to everyone, but gives an idea of how money could be segmented. Once you know how your money is segmented, you will have more idea about how much you can save and how much you could invest.