Capital gains tax is applicable when you sell ‘chargeable assets’ that have increased in value. A full list of chargeable assets can be found on the government website, with the most common assets being second homes, buy-to-let properties or shares that are not held in an ISA or LISA.

To work out if you have made a gain can be complicated, as you’re allowed to deduct certain costs from some chargeable assets. But in simple terms, a gain is the price you sold the item for minus any allowable losses, minus the price you paid for the item. If you think that you may be liable for capital gains tax when you sell an asset, it may be worth talking to a tax expert such as an accountant or regulated financial adviser to help you calculate this.

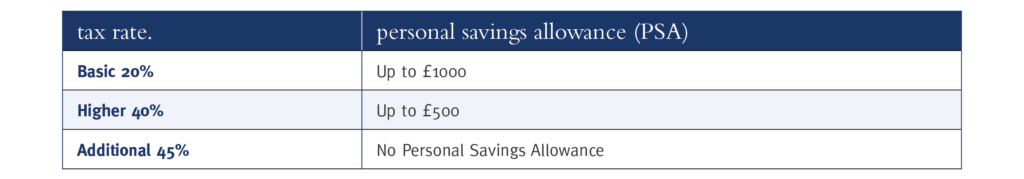

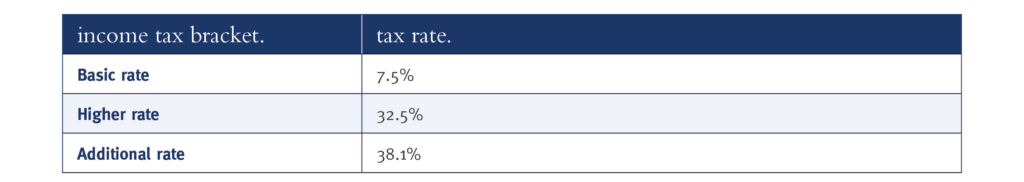

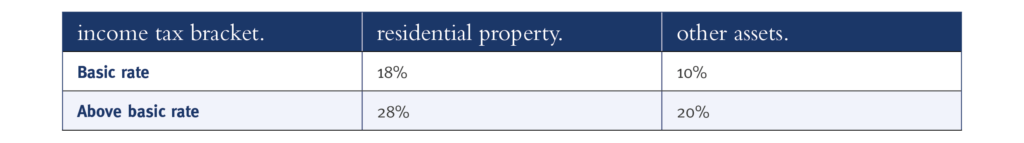

The first £12,300 of gains in the tax year are exempt from tax. Like your personal savings allowance and your dividend allowance, the rate of tax that you pay is dependent on your income tax bracket and what asset you have sold. Any gains above the £12,300 tax free allowance are charged as follows: