Mini-budget commentary 2022.

23rd September 2022

Following the government shake-up in the wake of Liz Truss taking over the reigns as Prime Minister, the new Chancellor Kwasi Kwarteng has today delivered his first ‘mini’ budget.

The budget has been delivered as a ‘growth plan’ as the UK tackles high inflation and climbing interest rates with the aim of achieving trend growth in the economy of 2.5%. The chancellor said the government will do that by expanding the supply side of the economy through tax incentives and reform – “That is how we will turn this vicious cycle of stagnation into a virtuous cycle of growth.”

National Insurance

In two early announcements yesterday, Mr Kwarteng has cancelled Rishi Sunak’s 1.25% rise in National Insurance (NI) and is also scrapping the ‘health and social care levy’ that was due to replace it in April next year. The reduced NI rates will take effect from 6 November.

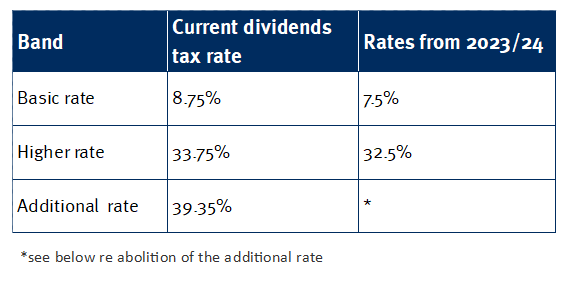

Yesterday’s statement also confirmed the reversal of the 1.25% increase to income tax on dividends which was introduced from April. The reversal will take effect from April 2023.

Dividend tax

The new dividend tax rates, which will apply across the UK, are:

Income tax

As heavily rumoured, the planned cut in the basic rate of income tax from 20% to 19% has been brought forward to next tax year (April 2023) from April 2024. And in a surprise announcement, the chancellor is also abolishing the top ‘additional rate’ of income tax which is currently 45% and paid by those earning over £150,000 in England, Wales and Northern Ireland. The additional rate for savings and dividends will also be removed and this change will apply UK-wide. As the additional rate of income tax will be removed, current additional rate taxpayers will also benefit from the Personal Savings Allowance of £500 for higher rate taxpayers.

Note – this could have some impact on any tax relief you get on pension contributions and Gift Aid donations. However, a four-year transition period for Gift Aid relief will apply, to maintain the income tax basic rate relief at 20% until April 2027. There will also be one-year transitional period for Relief at Source (RAS) pension schemes to permit them to continue to claim tax relief at 20%.

Stamp Duty

To boost the housing market, cuts are to be made to the Stamp Duty tax paid in England and Northern Ireland. The threshold before Stamp Duty is paid is raising from £125,000 to £250,000. First-time buyers currently pay no stamp duty on the first £300,000 and that will be raised to £425,000. “And we’re going to increase the value of the property on which first-time buyers can claim relief, from £500,000 to £625,000” he says, effective from today.

Other duties

And finally, the planned increases in the duty rates for beer, cider, wine and spirits will all be cancelled.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.