Spring Statement Commentary 2022.

23rd March 2022

The 2022 Spring Statement was delivered earlier today by the Chancellor, Rishi Sunak, against the backdrop of a cost of living crisis. Inflation hit a new 30 year high of 6.2% in February with the largest contributors to this figure being increased energy bills and rising fuel costs. Inflation is also set to rise further in the coming months due in part to the impact of the war in Ukraine and the rise in the energy cap, whilst there remains supply chain constraints following the coronavirus pandemic. All of which is further compounded by the planned 1.25% increase to National Insurance coupled with various tax allowance freezes. The Chancellor was therefore under pressure to relieve the burden on households who face a worsening ‘income squeeze’.

Fuel Duty

As was widely anticipated fuel duty was cut by 5p per litre and will come into effect immediately and will remain in place until March 2023.

VAT

The only change announced to VAT was in relation to energy saving materials such as solar panels and heat pumps, where homeowners will now pay 0% as opposed to 5% for the next 5 years.

National Insurance

The Chancellor had been urged prior to his statement to delay the planned increase of 1.25% in National Insurance due to come into effect from 6th April 2022. Whilst he hasn’t changed his mind on this increase, he has stated that the National Insurance threshold will increase by £3,000 in order to be brought in line with the income tax personal allowance of £12,570 from July 2022. People will therefore be able to earn £12,570 per annum and pay no income tax or National Insurance. This represents a tax giveaway of £6bn for 30m people, with a typical employee benefiting to the tune of £330 per annum, meaning that this is the largest single personal tax cut in a decade.

Income Tax

The Chancellor stated that before the end of this parliament in 2024, he plans to cut the basic rate of income tax from 20% to 19%, although there are no immediate reductions applicable. This is the first cut to the basic rate of income tax in 16 years.

Everyone has an income tax personal allowance. Currently, it is £12,570, meaning you can earn that much during the year before you start paying tax, and as previously announced it will remain frozen at this level until April 2026. Similarly, the higher rate tax threshold which presently stands at £50,270, will also remain frozen until 2026.

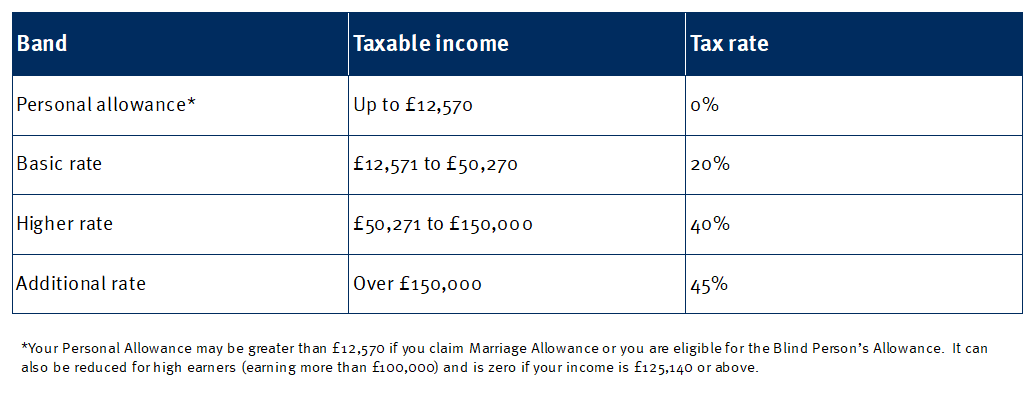

For information, set out below are the current tax rates and thresholds for England, Wales and Northern Ireland:

Income tax (Scotland)

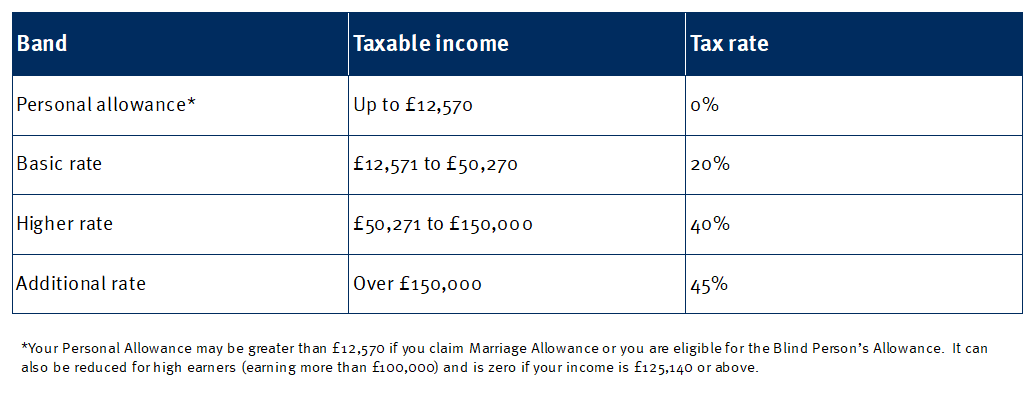

The Scottish Government sets out its spending and taxation plans for 2022/23 in its annual budget and the following rates and bands are applicable from 6th April 2022:

Dividend tax allowance

You only have to pay tax if your dividends exceed the dividend tax allowance in the tax year, which for 2022/23 will remain at £2,000. However, you don’t pay tax on dividends from shares in an ISA or a pension.

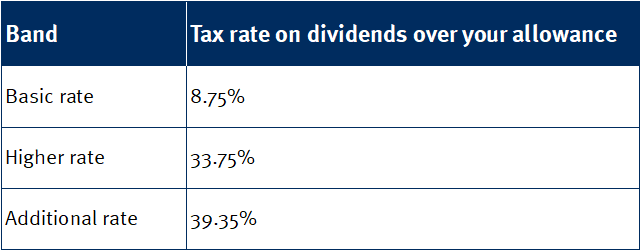

The tax you pay depends on your income band – please note, you must add your dividend income to any other taxable income to determine the rate of tax you will pay. As previously announced, for the 2022/23 tax year, the rates of dividend tax will be increasing by 1.25% in each band and will be as noted in the below table:

Personal savings allowance

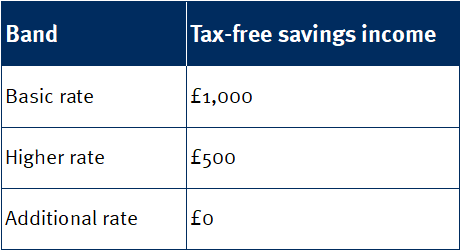

This was first introduced in 2016 and applies to savings income such as interest on savings accounts, gilts or corporate bonds. The allowance remains at £1,000 for basic rate tax payers and £500 for higher rate tax payers.

ISAs

The ISA allowance subscription limit for 2022/23 will remain unchanged at £20,000 and the annual subscription limit for Junior ISAs and Child Trust Funds will remain at £9,000.

CGT

No mention was made in relation to capital gains tax (CGT) rates and the annual exemption will remain unchanged at £12,300 for 2022/23 and frozen at this level until April 2026.

Above this, CGT will continue to be paid at 10% (18% for second properties or buy to let) if the chargeable gain fell within an individual’s basic rate band. Any gain that is above an individual’s basic rate band will be charged at 20% (28% for second properties or buy to let).

Pensions

State Pension

Those relying on the state pension are likely to be hit particularly hard by rising inflation. The ‘triple lock’ which saw the state pension increase by the higher of the rate of inflation, average wage increases, or 2.5% was suspended in 2021 in response to high wage increases, although the government has confirmed it will be brought back next year.

Pension Allowances

The Chancellor previously announced the freezing of the pension lifetime allowance at £1,073,100 until April 2026.

The lifetime allowance is the amount of pension funds people can accumulate before they are taxed on them. Any amount you have in your pension above the lifetime allowance is subject to a tax charge. It is a one-off charge of 25% if the excess is taken as income, or 55% if paid as a lump sum.

It has been the focus of change for many years since its introduction in 2006. The lifetime allowance originally started at £1.5m, rising steadily to £1.8m by 2011 before being cut to a low of £1m by 2016. Since 2018, the allowance has generally risen in line with inflation.

Offering no increases to the lifetime allowances is an example of a ‘stealth tax’ and many pensioners can be dragged into the lifetime allowance tax net. Although this will only impact people who already have substantial pension pots, the limit could be closer than some realise, and not just for high earners but also those in valuable final salary pension schemes.

In addition the annual allowance, which is the limit on tax relievable pension savings that can be made in any one tax year remains at £40,000, and has been at this level since April 2016. Pension savers are therefore limited both on their contributions and on the amounts that they can accumulate and there is also a real risk that freezing the annual and lifetime allowances will only discourage and make more difficult saving towards retirement.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.